This month, there’s a lot of talk when it comes to money. And it needs to continue.

With Talk Money Week 2022, there are plenty of events and activities where we’re able to talk openly and frankly about all things financial. From pensions to ISAs, there’s a lot of jargon that comes with talking about money – as well as plenty of hesitation. Despite this, there are some good reasons to talk openly about finances.

Stay informed

Having conversations with others helps us learn. Conversations about money are no different. At a time when news sources are filled with talk about interest rates and inflation, it can all begin to sound like another language. If you don’t understand, have a conversation about it.

Knowing about money puts you in control of your own. Talking with others is the beginning of learning some really useful financial skills and tools – like where your money works best and how to get the most out of your accounts. At worst, you’ll have a laugh when you realise your friends don’t fully understand what inflation is either!

Build relationships

It takes trust to open up to someone about your finances. The strongest relationships are built on a solid foundation of trust.

It’s so easy to get tangled up in our own heads and forget that we’re surrounded by others who are willing to help.

Maybe money is getting tight, and you’re contemplating a risky financial decision that’s, by all accounts, not wise. You’ll likely find a way to justify it to yourself in your head, but speaking to a loved one will keep you grounded. There might be solutions you haven’t explored yet. Visit moneysavingexpert.com for some really helpful resources on managing your money.

Lead the way

It’s one thing to receive good advice, but talking about money can also put you in the driver’s seat. Particularly with children, giving a transparent look at money can pave the way to financial independence in the future.

A really useful, practical skill to give a child is how to budget. Talk to them and show them how it works. What money comes in? Where does it go?

Talking openly will give them the tools to make wise financial decisions when it’s their time.

Put your mind at ease

If talking about money is a problem, we know talking about problems always helps. We’ve all heard the expression ‘a problem shared is a problem halved’.

Whether you talk to a friend, a loved one or an accredited organisation, you can reduce anxiety and worry by sharing financial difficulties you might have. Having financial worries can be a driver of loneliness and isolation, negatively impacting mental and physical health. It doesn’t have to be that way.

You’re not alone

You can find a full list of activities and events, as well as helpful resources for Talk Money Week and beyond at maps.org.uk/talk-money-week. If things are proving difficult for you, especially as the cost of living crisis continues to hit more households across the UK, there are places you can turn. Christians Against Poverty (CAP) offers free, non-judgemental debt advice.

With job clubs, money courses and community groups based in churches across the UK, you’ll find that talking about your finances really is the start of your journey to financial freedom. Visit capuk.org/help to find out more.

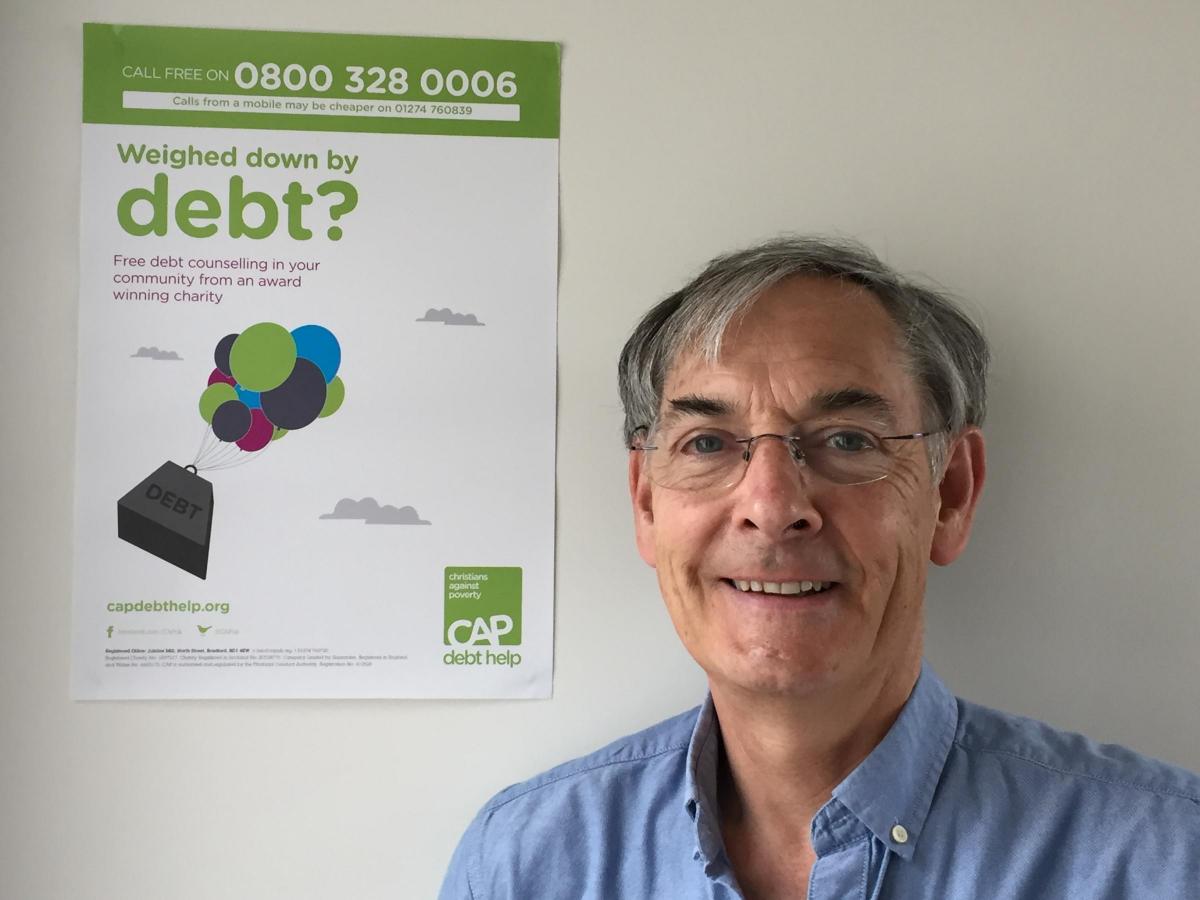

Jonathan Hayward is the manager of the West NI Debt Centre operated by the Enniskillen Presbyterian Church in partnership with Christians Against Poverty (CAP) which is a UK charity with over 580 services across the country delivering free debt counselling, and money management courses.Both these services are freely to everyone in Enniskillen. Visit capuk.org to find out more.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here